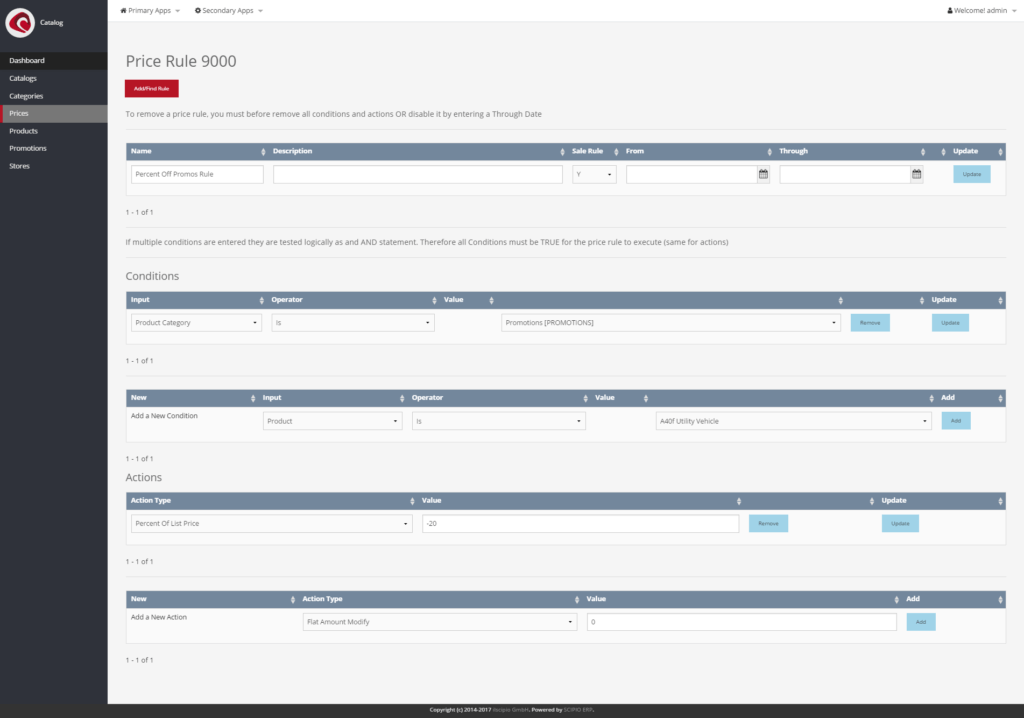

Complexe Price Rule example

Prices in Scipio ERP are not always absolute amounts, but can be a combination of a base amount, taxes, promotional discounts, voucher codes and more. Fees can be configured as well. One could, for example, define a list price for a product, add a VAT tax, have a promotion which discounts 10% and then finally add a sales tax to an order.

Some price configurations are not applied to a single product, but rather associated with other aspects of the applications. Good examples are orders (taxes, promotions), categories, geo locations or webstores / sales channels. Taxes are defined on a tax authority level and can be applied to products automatically based on location, order, product & category. One can configure invoice taxes, sales taxes, return sales taxes, VAT, use tax and more. Additional taxes (export / import taxes) can also be used when appropriate. There is also a promotion builder which can apply a large combination of rebates, such as: percent/fixed amount discount or free item based on product/category/catalog/purchase during hour/bonus points/geo location/webstore/marketing campaign (lifetime tracking) etc. Voucher codes are also available and can be generated or imported.

All of which are addressed and configured in different applications

- Product Prices (Catalog)

- product prices (default price, list price, recurring prices etc.)

- Tax in price

- external price calculation services

- (Global) Prices (Catalog)

- Price Rules that are applied to all products

- Categorical Prices (Catalog)

- VAT Tax percentages

- Other Taxes (Accounting)

- Sales Tax etc.

- Promotions (Catalog)

- Complexe price rules for promotional purposes

- Promo Codes (Vouchers)